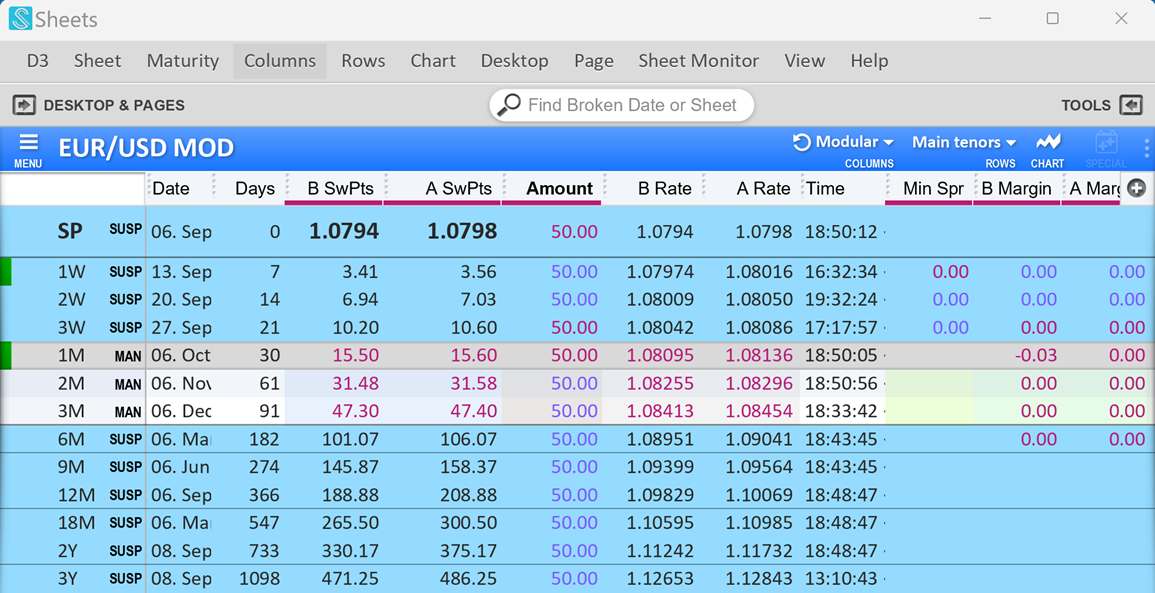

Furthermore, it facilitates traders to have one view of their curve and have the ability to join the market and place an order where the market is, rather than where their curve is.

FX Swaps trading between banks and buy-side clients, the so-called dealer-to-client channel, is already highly electronic. However, the interdealer market has been slower to migrate towards more electronic trading, mainly due to the complexity of pricing along the forward curve.

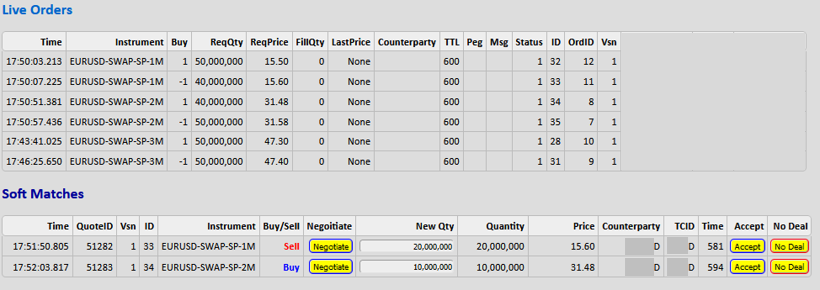

The system offers advanced order management capability using specialised logic built for the FX Swaps market and combining DIGITEC’s unique expertise and experience across workflow automation and trading, driving new levels of automation in this market.

D3 OMS is currently connected to 360T SUN and LSEG FX Forwards Matching, with more venues to be added.