The PMF advantage

The PMF can be used for a number of purposes:

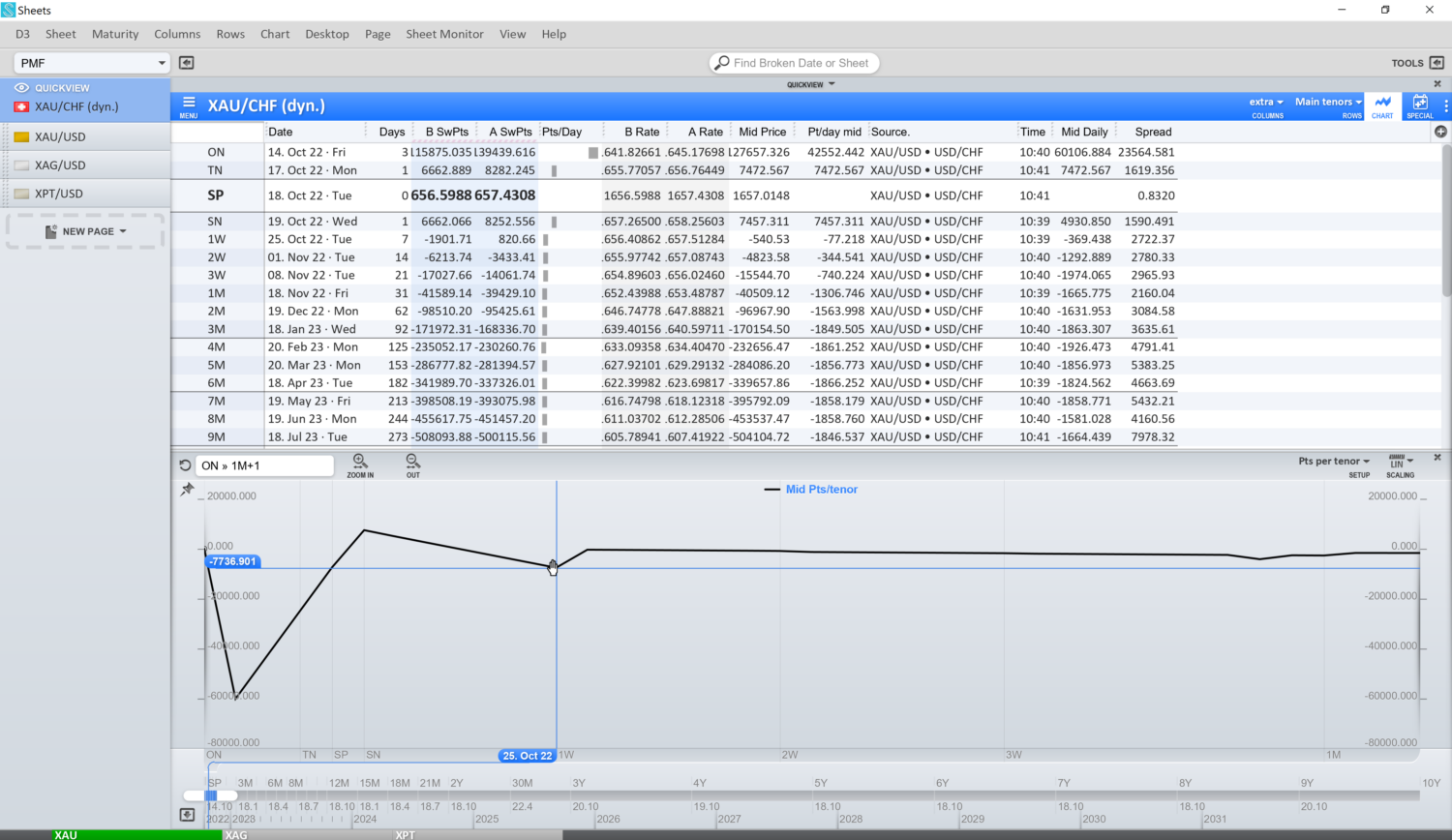

- Evaluation of your outbound Forward curves

- Assessment of best execution

- Comparison of true executable pricing in the Forwards market

- Rate reasonability compliance

- Historical back-testing and model development

- Academic research

Key features

- Independent market data that reflects the real market, created by pricing engines and traders

- Access to special dates such as turn dates around the year, quarter, month end / beginning, IMM’s as well as central bank meetings

- Ability to request any broken date and any cross combination up to 2 years

- Algorithm sanity checks – outliers are dropped out automatically to ensure best data quality

- Up to 1000 parallel subscriptions are possible

Distribution

We offer various customisable subscription models:

- FIX-API based feed with no limitation to the number of users and consuming in-house applications

- Seamless integrated access via DIGITEC’s D3 Pricing Engine

- Seamless integrated access via the 360T platform (EMS, ADS & MMC)

- View-only webpage access

Meet our partner

As Deutsche Börse Group’s FX powerhouse, 360T provides web-based trading technology for OTC instruments, integration solutions and related services. In addition to its existing cutting-edge multi-bank portal for FX, Cash, Money Market and MM Funds products, together with Deutsche Börse Group, it provides its clients with the most holistic offering on the market by combining FX OTC and on-exchange FX trading. 360T allows clients to directly reduce their operational costs and risks in all parts of the trading lifecycle while enhancing compliance and transparency at the same time.