The best of both systems combined

Stream your D3 created curves seamlessly into 360T’s trading applications.

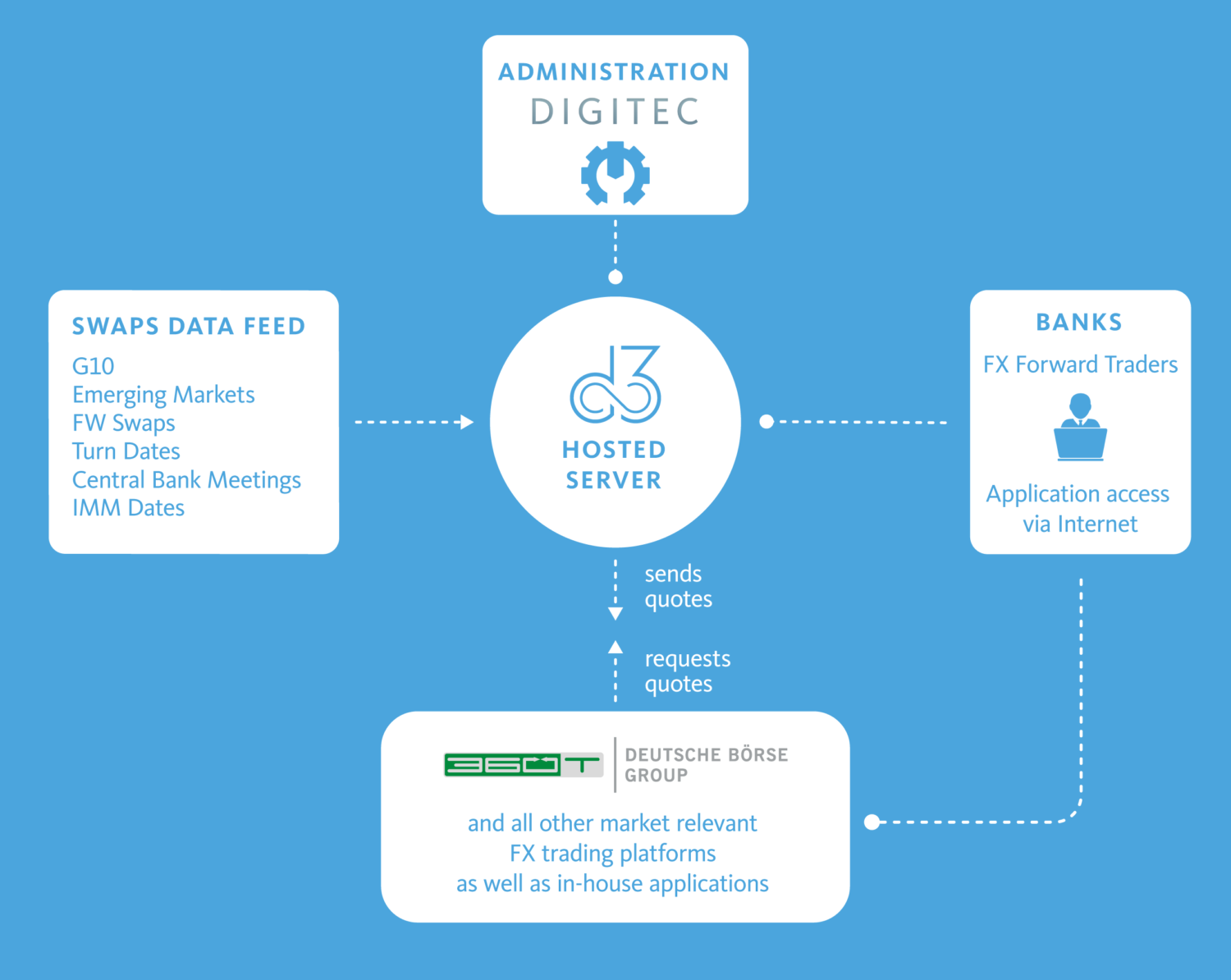

You get the best out of DIGITEC and 360T in one box: The combination of DIGITEC’S well-known D3 Pricing and 360T’s award winning multi-bank trading platform for FX and MM products. This partnership allows us to provide banks with complete solution to today’s required trading infrastructure on a pay-as-you-go cost structure. Our trading infrastructure comes along with a proprietary market data feed, all the necessary price setting, quality and risk management features of the latest D3 release and 360T’s Market Maker Cockpit and Auto Dealing Suite.

Benefits for banks

Rapidly increased trading volume

Instantly be a market leader and widely visible E-commerce participant

Tradable financial instruments

FX Forward, Swaps, NDFs and MM Rates

Market data inclusive

Market data covers standard tenors up to 2 years and features special dates such as turn dates, IMM & central bank meetings which makes it unique in the market.

Highest data quality

Our market data is interbank trading quality. Several sanity checks and other security algorithms ensure highest market data quality.

Available ccy’s

More than 40 CCY pairs, across G10, LM, NDF pairs with all Cross CCY combinations

Reduce risk and cost

Easy to install and D3`s safety features help you ensure correct pricing quotes; hosted application minimizes costs for hardware and tech support.

Meet our partner

As Deutsche Börse Group’s FX powerhouse, 360T provides web-based trading technology for OTC instruments, integration solutions and related services. In addition to its existing cutting-edge multi-bank portal for FX, Cash, Money Market and MM Funds products, together with Deutsche Börse Group, it provides its clients with the most holistic offering on the market by combining FX OTC and on-exchange FX trading. 360T allows clients to directly reduce their operational costs and risks in all parts of the trading lifecycle while enhancing compliance and transparency at the same time.

We have answers!

Get quickly answers of most frequently asked questions about market data.